Bike EMI Calculator – Calculate Your Two Wheeler Loan EMI Instantly

Planning to buy your dream bike but worried about monthly payments? A bike EMI calculator is your perfect financial planning companion that helps you calculate two-wheeler loan EMI in seconds. Whether you’re eyeing a sporty street bike, a comfortable commuter, or a premium cruiser, understanding your EMI before taking a loan is crucial for smart financial planning.

In this comprehensive guide, we’ll walk you through everything about the bike EMI calculator, how it works, the calculation formula, factors affecting your EMI, and how to use it effectively to make informed borrowing decisions.

Table of Contents

What is a Bike EMI Calculator? Two Wheeler Loan EMI Calculator Explained

Bike EMI Calculator Definition and Purpose

A bike EMI calculator is a free online financial tool that helps you calculate the Equated Monthly Installment (EMI) you’ll need to pay when taking a two-wheeler loan. This digital calculator instantly computes your monthly payment obligations based on three key parameters:

- Loan Amount (Principal) – The total money you’re borrowing

- Interest Rate – The rate charged by the lender (annual percentage)

- Loan Tenure – The repayment period in months or years

Why Use a Bike EMI Calculator for Two Wheeler Loans?

✅ Instant Results: Get accurate EMI calculations within seconds ✅ Financial Planning: Plan your monthly budget effectively ✅ Compare Options: Evaluate different loan scenarios easily ✅ No Manual Errors: Automated calculations ensure 100% accuracy ✅ Free to Use: Unlimited calculations without any charges ✅ Informed Decisions: Choose the right loan amount and tenure ✅ Budget Management: Ensure EMI fits comfortably in your income

According to industry data, over 13.5 million two-wheelers were sold in India in 2022, with a significant portion financed through loans. Using a bike EMI calculator before applying helps buyers avoid overborrowing and financial stress.

How Does a Bike EMI Calculator Work? Two Wheeler EMI Calculation Process

Bike EMI Calculator Working Mechanism

When you input values into a bike EMI calculator, it uses a standardized mathematical formula to calculate your monthly installment. Here’s the step-by-step process:

Step 1: Data Input You enter three essential values:

- Principal loan amount (e.g., ₹80,000)

- Annual interest rate (e.g., 12%)

- Loan tenure (e.g., 36 months)

Step 2: Rate Conversion The calculator converts the annual interest rate to a monthly rate by dividing it by 12 months and then by 100.

Step 3: Formula Application The calculator applies the EMI formula to compute your monthly payment.

Step 4: Instant Results Within milliseconds, you get:

- Monthly EMI amount

- Total interest payable

- Total amount payable (Principal + Interest)

Step 5: Amortization Schedule (Advanced Calculators) Some calculators also generate a payment schedule showing principal vs. interest breakdown for each month.

Bike EMI Calculator Formula: Two Wheeler Loan EMI Calculation Formula Explained

Mathematical Formula for Bike EMI Calculator

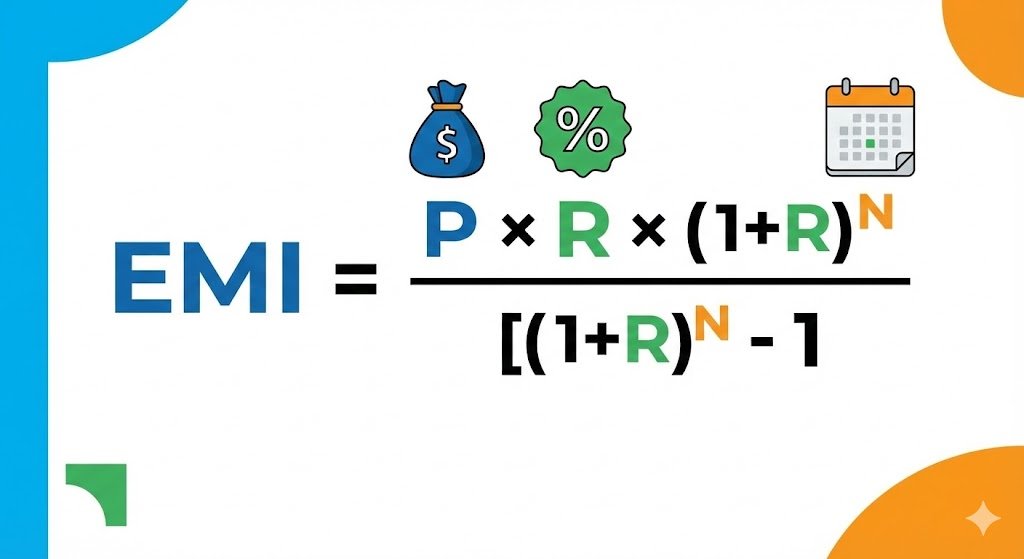

The bike EMI calculation formula used by all lenders and calculators is:

EMI = [P × R × (1+R)^N] / [(1+R)^N - 1]

Where:

- P = Principal loan amount (the amount borrowed)

- R = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan tenure in months

- ^ = Power/Exponent

Bike EMI Calculator Formula Breakdown with Example

Let’s understand this with a practical example:

Scenario: You want to buy a bike worth ₹1,00,000

| Parameter | Value |

|---|---|

| Bike Price | ₹1,00,000 |

| Down Payment (20%) | ₹20,000 |

| Loan Amount (P) | ₹80,000 |

| Annual Interest Rate | 12% p.a. |

| Monthly Interest Rate (R) | 12 ÷ 12 ÷ 100 = 0.01 |

| Loan Tenure | 4 years |

| Tenure in Months (N) | 48 months |

Applying the Formula:

EMI = [80,000 × 0.01 × (1+0.01)^48] / [(1+0.01)^48 - 1]

EMI = [80,000 × 0.01 × 1.6122] / [1.6122 - 1]

EMI = [1,289.76] / [0.6122]

EMI = ₹2,107

Result:

- Monthly EMI: ₹2,107

- Total Interest: ₹21,136

- Total Amount Payable: ₹1,01,136

Simplified Bike EMI Calculator Formula Understanding

For those who find the formula complex, remember these key relationships:

- Higher Loan Amount → Higher EMI

- Higher Interest Rate → Higher EMI

- Longer Tenure → Lower EMI (but higher total interest)

- Shorter Tenure → Higher EMI (but lower total interest)

How to Use a Bike EMI Calculator: Step-by-Step Guide for Two Wheeler Loans

Using a Bike EMI Calculator Online – Complete Process

Follow these simple steps to calculate your bike loan EMI:

Step 1: Access the Calculator

- Visit your bank’s website (HDFC, ICICI, SBI, Bajaj Finance, etc.)

- Navigate to “Loans” → “Two Wheeler Loan” → “EMI Calculator”

- Or use popular financial websites like BankBazaar, Groww, or BikeDekho

Step 2: Enter Loan Amount

- Use the slider or input box

- Enter the amount you wish to borrow

- Typically ranges from ₹30,000 to ₹25,00,000

- Tip: Loan Amount = Bike Price – Down Payment

Step 3: Set Interest Rate

- Input the interest rate offered by your lender

- Current rates range from 0.99% to 28% p.a.

- Check with multiple lenders for best rates

- Your credit score affects the rate offered

Step 4: Choose Loan Tenure

- Select repayment period: 6 months to 60 months (5 years)

- Use the slider or dropdown menu

- Remember: Longer tenure = Lower EMI but higher total interest

Step 5: View Results The calculator instantly displays:

- Monthly EMI Amount: Your fixed monthly payment

- Principal Amount: Original loan borrowed

- Total Interest: Interest paid over loan tenure

- Total Payment: Principal + Interest

Step 6: Adjust and Compare

- Modify values to see different scenarios

- Compare EMIs across different tenures

- Find the most affordable option for your budget

Bike EMI Calculator Tips for Best Results

💡 Calculate Multiple Scenarios: Try different down payments and tenures 💡 Add Processing Fees: Remember to add 1-2% processing charges 💡 Consider Your Income: EMI should not exceed 40% of monthly income 💡 Check Hidden Charges: Factor in foreclosure charges if planning prepayment 💡 Compare Lenders: Different banks offer different rates

Bike EMI Calculator Example: Real-World Two Wheeler Loan Calculations

Bike EMI Calculator Sample Calculations for Different Scenarios

Let’s see how EMI changes with different parameters:

Scenario 1: Budget Commuter Bike

| Details | Values |

|---|---|

| Bike Model | Hero Splendor Plus |

| Bike Price | ₹70,000 |

| Down Payment (15%) | ₹10,500 |

| Loan Amount | ₹59,500 |

| Interest Rate | 15% p.a. |

| Tenure | 24 months |

| Monthly EMI | ₹2,893 |

| Total Interest | ₹9,932 |

| Total Payment | ₹69,432 |

Scenario 2: Sporty 125cc Bike

| Details | Values |

|---|---|

| Bike Model | Hero Xtreme 125R |

| Bike Price | ₹1,10,000 |

| Down Payment (20%) | ₹22,000 |

| Loan Amount | ₹88,000 |

| Interest Rate | 12% p.a. |

| Tenure | 36 months |

| Monthly EMI | ₹2,924 |

| Total Interest | ₹17,264 |

| Total Payment | ₹1,05,264 |

Scenario 3: Premium 200cc Bike

| Details | Values |

|---|---|

| Bike Model | Bajaj Pulsar NS200 |

| Bike Price | ₹1,50,000 |

| Down Payment (25%) | ₹37,500 |

| Loan Amount | ₹1,12,500 |

| Interest Rate | 11.5% p.a. |

| Tenure | 48 months |

| Monthly EMI | ₹2,945 |

| Total Interest | ₹28,860 |

| Total Payment | ₹1,41,360 |

Scenario 4: Premium Superbike

| Details | Values |

|---|---|

| Bike Model | Royal Enfield Interceptor 650 |

| Bike Price | ₹3,20,000 |

| Down Payment (30%) | ₹96,000 |

| Loan Amount | ₹2,24,000 |

| Interest Rate | 10% p.a. |

| Tenure | 60 months |

| Monthly EMI | ₹4,756 |

| Total Interest | ₹61,360 |

| Total Payment | ₹2,85,360 |

Bike EMI Calculator Comparison: Impact of Tenure

See how tenure affects EMI for the same ₹1,00,000 loan at 12% interest:

| Tenure | Monthly EMI | Total Interest | Total Payment |

|---|---|---|---|

| 12 months | ₹8,885 | ₹6,620 | ₹1,06,620 |

| 24 months | ₹4,708 | ₹12,992 | ₹1,12,992 |

| 36 months | ₹3,321 | ₹19,556 | ₹1,19,556 |

| 48 months | ₹2,633 | ₹26,384 | ₹1,26,384 |

| 60 months | ₹2,224 | ₹33,440 | ₹1,33,440 |

Key Insight: Doubling the tenure from 24 to 48 months reduces EMI by 44% but increases total interest by 103%!

Factors Affecting Bike EMI Calculator Results: What Influences Two Wheeler Loan EMI?

Key Factors That Determine Your Bike Loan EMI

1. Principal Loan Amount (Biggest Impact)

The loan amount is the primary factor determining your EMI. It’s calculated as:

Loan Amount = Bike’s On-Road Price – Down Payment

Impact Example:

- Loan of ₹50,000 @ 12% for 24 months = ₹2,354 EMI

- Loan of ₹1,00,000 @ 12% for 24 months = ₹4,708 EMI

- Doubling loan doubles EMI

How to Control:

- Make a higher down payment (20-30%)

- Consider a slightly lower-priced bike model

- Opt for exchange bonus if trading in old bike

2. Interest Rate (Critical Factor)

Interest rates in India for two-wheeler loans range from 0.99% to 28% p.a. depending on:

Factors Affecting Interest Rate:

- Credit Score: 750+ gets best rates

- Lender Type: Banks vs. NBFCs vs. Dealer financing

- Employment Status: Salaried vs. Self-employed

- Bike Type: Commuter vs. Premium vs. Electric

- Loan Tenure: Shorter tenure may get lower rates

- Relationship with Bank: Existing customers may get discounts

Current Market Rates (November 2025):

| Lender | Interest Rate Range | Processing Fee |

|---|---|---|

| ICICI Bank | 14.50% p.a. | 2% + GST |

| HDFC Bank | 14.50% p.a. | Up to ₹5,000 |

| SBI | 16.25% – 18.00% p.a. | 2% (min ₹1,000) |

| Bajaj Finance | 6.60% – 28.00% p.a. | Varies |

| Hero FinCorp | Competitive rates | Varies |

| Tata Capital | 8.50% – 18.99% p.a. | Up to 2% |

Impact Example (₹1,00,000 for 36 months):

- @ 10% interest: EMI = ₹3,227 | Total Interest = ₹16,172

- @ 15% interest: EMI = ₹3,466 | Total Interest = ₹24,776

- 5% rate difference adds ₹8,604 extra interest!

3. Loan Tenure (Balancing Factor)

Tenure flexibility: 6 months to 60 months (5 years)

Tenure Impact:

Shorter Tenure (12-24 months): ✅ Lower total interest paid ✅ Faster debt clearance ✅ Better for high-income borrowers ❌ Higher monthly EMI burden ❌ May strain monthly budget

Longer Tenure (36-60 months): ✅ Lower monthly EMI ✅ Better cash flow management ✅ Easier to fit into budget ❌ Higher total interest cost ❌ Longer debt obligation

Optimal Tenure Calculation: Your EMI should not exceed 35-40% of your net monthly income.

Example:

- Monthly Income: ₹30,000

- Maximum Recommended EMI: ₹10,500 (35%)

- For ₹1,00,000 loan @ 12%:

- 24 months = ₹4,708 EMI ✅ Comfortable

- 12 months = ₹8,885 EMI ⚠️ Tight budget

4. Down Payment (Initial Investment)

Down payment typically ranges from 10% to 30% of bike’s price.

Down Payment Impact:

| Down Payment | Loan Needed | EMI @ 12% (36m) | Total Interest |

|---|---|---|---|

| 10% (₹10,000) | ₹90,000 | ₹2,989 | ₹17,604 |

| 20% (₹20,000) | ₹80,000 | ₹2,657 | ₹15,652 |

| 30% (₹30,000) | ₹70,000 | ₹2,324 | ₹13,664 |

Benefits of Higher Down Payment: ✅ Reduces loan amount significantly ✅ Lowers monthly EMI burden ✅ Decreases total interest paid ✅ May qualify you for better interest rates ✅ Reduces loan tenure needed

Zero Down Payment Options: Some lenders offer 100% financing on bike’s on-road price, but:

- Interest rates may be higher (0.5-1% extra)

- Credit score requirements are stricter (750+)

- Processing fees may be higher

- Better suited for those with strong income proof

5. Credit Score (Qualification Factor)

Your credit score (CIBIL Score) directly impacts:

- Loan Approval: Score below 650 may face rejection

- Interest Rate: Better score = Lower rate

- Loan Amount: Higher score = Higher eligibility

Credit Score Impact:

| Score Range | Loan Prospects | Expected Rate |

|---|---|---|

| 750+ | Excellent – Best rates | 10-12% p.a. |

| 700-749 | Good – Standard rates | 12-15% p.a. |

| 650-699 | Fair – Higher rates | 15-20% p.a. |

| Below 650 | Poor – May be rejected | 20%+ or rejected |

6. Processing Fees and Other Charges

Often overlooked, these add to your total cost:

Common Charges:

- Processing Fee: 1-2% of loan amount (₹500-₹5,000)

- Documentation Charges: ₹500-₹1,000

- Stamp Duty: Varies by state

- Prepayment Charges: 2-5% if closing loan early

- Late Payment Penalty: ₹500-₹1,000 per instance

Example Total Cost:

- Bike Price: ₹1,00,000

- Down Payment: ₹20,000

- Loan Amount: ₹80,000

- Processing Fee (2%): ₹1,600

- Documentation: ₹500

- Initial Cash Needed: ₹20,000 + ₹1,600 + ₹500 = ₹22,100

Benefits of Using a Bike EMI Calculator: Why Two Wheeler Loan Calculator is Essential

Top Advantages of Bike EMI Calculator for Borrowers

1. Instant Financial Clarity

- Know exact monthly obligation before applying

- No surprises after loan approval

- Plan other expenses accordingly

2. Compare Multiple Loan Options

- Try different lenders’ rates instantly

- Evaluate various tenure options

- Find the sweet spot for your budget

3. Accurate Budgeting

- Ensure EMI fits within income

- Avoid over-borrowing

- Plan for other monthly expenses

4. Time-Saving Tool

- Instant calculations vs. manual computation

- No need to visit banks for estimates

- Calculate anytime, anywhere

5. Error-Free Calculations

- Eliminates manual calculation mistakes

- Uses standardized formula

- 100% accurate results

6. Informed Decision Making

- Understand true cost of borrowing

- See total interest paid over tenure

- Make data-driven loan choices

7. Negotiation Power

- Know market rates before dealer visit

- Compare dealer finance vs. bank loans

- Negotiate for better terms

8. Financial Planning

- Plan for loan prepayment

- Decide optimal down payment

- Manage long-term cash flow

Bike Loan Interest Rates India 2025: Current Two Wheeler Loan Rates

Latest Bike Loan Interest Rates from Top Lenders

Interest rates are continuously changing. Here are the current ranges (November 2025):

| Bank/NBFC | Interest Rate | Loan Amount | Tenure | Processing Fee |

|---|---|---|---|---|

| ICICI Bank | 14.50% p.a. | Up to ₹30 lakh | Up to 48 months | 2% + GST |

| HDFC Bank | 14.50% p.a. | Contact bank | Up to 48 months | Up to ₹5,000 |

| SBI | 16.25%-18.00% p.a. | ₹30,000-₹2.5L | Up to 60 months | 2% (min ₹1,000) |

| Bajaj Finance | 6.60%-28.00% p.a. | Up to ₹25 lakh | 6-60 months | Varies |

| Hero FinCorp | 11%-17% p.a. | Up to ₹25 lakh | 12-48 months | 1-2% |

| Tata Capital | 8.50%-18.99% p.a. | Up to ₹1.5 lakh | 6-48 months | Up to 2% |

| IDFC FIRST Bank | 8.50%-18.99% p.a. | Contact bank | 6-48 months | Varies |

| Shriram Finance | 11.5%-18% p.a. | ₹30,000-₹25L | 12-60 months | Varies |

Rate Categories:

- Premium Segment: 8.50%-12% p.a. (High-end bikes, superbikes)

- Electric Two-Wheelers: 15.99% p.a. (Govt. subsidies may apply)

- Commuter Segment: 16%-18.99% p.a. (Regular bikes, scooters)

- Used Two-Wheelers: 18%-20% p.a. (Second-hand bikes)

Factors Determining Your Interest Rate

You’ll Get Lower Rates If: ✅ Credit score is 750 or above ✅ You’re a salaried professional with stable income ✅ You have existing relationship with the bank ✅ You opt for shorter loan tenure ✅ You’re buying a new, popular bike model ✅ You make higher down payment (30%+)

You’ll Face Higher Rates If: ❌ Credit score is below 700 ❌ You’re self-employed without substantial ITR ❌ You’re a first-time borrower with no credit history ❌ You opt for maximum tenure ❌ You’re buying a used or uncommon bike ❌ You request zero down payment loan

Types of Two Wheeler Loans: Different Bike Loan Options and EMI Calculators

1. New Bike Loan EMI Calculator

For Brand New Motorcycles and Scooters

Features:

- Financing: 70% to 100% of on-road price

- Interest Rates: 8.50% – 18.99% p.a.

- Tenure: 6 months to 60 months

- Down Payment: 10% to 30% typically

- Processing Time: 24 hours to 7 days

Best For: First-time buyers, upgrading from old bike, buying latest models

2. Used Bike Loan EMI Calculator

For Pre-Owned Two-Wheelers

Features:

- Financing: 50% to 80% of bike value

- Interest Rates: 18% – 22% p.a. (higher than new)

- Tenure: 12 months to 48 months

- Age Limit: Bike should be less than 5-7 years old

- Documentation: More extensive (RC transfer, valuation report)

Best For: Budget buyers, students, testing a bike category before new purchase

3. Electric Two Wheeler Loan EMI Calculator

For EVs – Scooters and Motorcycles

Features:

- Interest Rates: 15.99% p.a. (special EV rates)

- Tenure: Up to 48 months

- Additional Incentives: FAME II subsidies, state incentives

- Battery Coverage: Some lenders offer battery replacement insurance

- Lower EMI due to government subsidies

Popular EV Models:

- Ather 450X: ₹1.5-1.7 lakh

- TVS iQube: ₹1.2-1.5 lakh

- Ola S1 Pro: ₹1.3-1.5 lakh

- Bajaj Chetak: ₹1.2-1.5 lakh

Best For: Environmentally conscious buyers, city commuters (lower running costs)

4. Zero Down Payment Bike Loan EMI Calculator

100% Financing on Two-Wheelers

Features:

- Financing: 100% of on-road price

- Interest Rates: Slightly higher (0.5-1% extra)

- Eligibility: Stricter (income ₹12,000+/month, credit score 750+)

- Processing: Same day approval possible

- Tenure: Flexible 12-60 months

Requirements:

- Minimum monthly income: ₹12,000-₹15,000

- Strong credit score: 750+

- Stable employment: 1+ year in current job

- Co-applicant may be required for young applicants

Best For: Those with strong income but limited immediate savings

5. Superbike Loan EMI Calculator

For Premium High-End Motorcycles

Features:

- Loan Amount: ₹5 lakh to ₹25 lakh+

- Interest Rates: 8.50% – 12% p.a. (best rates)

- Tenure: Up to 60 months

- Down Payment: 20-30% recommended

- Eligibility: High income proof required

Popular Superbikes:

- Royal Enfield Interceptor 650: ₹3.2 lakh

- Kawasaki Ninja 300: ₹3.3 lakh

- KTM Duke 390: ₹3.1 lakh

- BMW G 310 R: ₹2.9 lakh

Best For: Enthusiasts, high-income professionals, premium bike collectors

Bike Loan Amortization Schedule: Understanding Two Wheeler EMI Breakdown

What is a Bike Loan Amortization Schedule?

An amortization schedule is a detailed table showing how your EMI is split between principal repayment and interest payment for each month of the loan tenure.

How Bike Loan Amortization Works

Key Concept: In the initial months, a larger portion of your EMI goes toward interest. As time progresses, more of your EMI pays off the principal.

Example Amortization Schedule Loan: ₹1,00,000 | Rate: 12% p.a. | Tenure: 24 months | EMI: ₹4,707

| Month | EMI | Principal | Interest | Outstanding Balance |

|---|---|---|---|---|

| 1 | ₹4,707 | ₹3,707 | ₹1,000 | ₹96,293 |

| 2 | ₹4,707 | ₹3,744 | ₹963 | ₹92,549 |

| 3 | ₹4,707 | ₹3,781 | ₹925 | ₹88,768 |

| 6 | ₹4,707 | ₹3,894 | ₹813 | ₹73,257 |

| 12 | ₹4,707 | ₹4,089 | ₹618 | ₹47,952 |

| 18 | ₹4,707 | ₹4,302 | ₹405 | ₹23,468 |

| 24 | ₹4,707 | ₹4,660 | ₹47 | ₹0 |

Total Paid: ₹1,12,968 (Principal: ₹1,00,000 | Interest: ₹12,968)

Key Takeaways from Amortization

- First EMI: ₹3,707 principal + ₹1,000 interest (78% principal, 22% interest)

- Mid-Point (Month 12): ₹4,089 principal + ₹618 interest (87% principal)

- Last EMI: ₹4,660 principal + ₹47 interest (99% principal, 1% interest)

Why This Matters:

- If you prepay loan early, you save on future interest

- Prepaying in first 2 years gives maximum savings

- Understanding breakdown helps plan prepayment strategy

How to Reduce Your Bike Loan EMI: Smart Tips for Lower Two Wheeler EMI

Proven Strategies to Lower Your Bike EMI Calculator Results

Strategy 1: Increase Your Down Payment

How It Works: Higher down payment → Lower loan amount → Lower EMI

Example: Bike Price: ₹1,20,000 | Rate: 12% | Tenure: 36 months

| Down Payment | Loan Amount | Monthly EMI | Savings |

|---|---|---|---|

| 10% (₹12,000) | ₹1,08,000 | ₹3,586 | Base |

| 20% (₹24,000) | ₹96,000 | ₹3,188 | ₹398/month |

| 30% (₹36,000) | ₹84,000 | ₹2,789 | ₹797/month |

Annual Saving with 30% down payment: ₹9,564!

Strategy 2: Negotiate Interest Rate

How It Works:

- Compare rates from 3-4 lenders

- Leverage competition

- Use existing bank relationship

Impact Example (₹1,00,000 loan for 36 months):

- @ 15%: EMI = ₹3,466 | Total Interest = ₹24,776

- @ 12%: EMI = ₹3,321 | Total Interest = ₹19,556

- Saving: ₹5,220 over loan tenure!

Negotiation Tips: ✅ Show lower quotes from competitors ✅ Mention your good credit score ✅ Offer to open salary account with bank ✅ Consider balance transfer if existing customer

Strategy 3: Extend Loan Tenure

How It Works: Longer tenure spreads payments → Lower monthly EMI

Trade-off: ✅ Pro: Lower immediate cash outflow ❌ Con: Higher total interest paid

Example (₹1,00,000 @ 12%):

- 24 months: EMI = ₹4,707 | Interest = ₹12,968

- 36 months: EMI = ₹3,321 | Interest = ₹19,556

- 48 months: EMI = ₹2,633 | Interest = ₹26,384

When to Use: If EMI exceeds 40% of income, extend tenure temporarily

Strategy 4: Improve Your Credit Score

Before Applying:

- Check credit report for errors

- Pay off small outstanding debts

- Ensure credit utilization below 30%

- Avoid multiple loan inquiries

Timeline: Give yourself 3-6 months to improve score from 650 to 750+

Impact:

- 700 score: 15% interest

- 750+ score: 12% interest

- Saves 3% annually = ₹3,000 on ₹1 lakh loan

Strategy 5: Choose Right Loan Tenure

Optimal Tenure Formula: EMI should be ≤ 35-40% of monthly income

Example:

- Monthly Income: ₹40,000

- Maximum Comfortable EMI: ₹14,000

- For ₹1,50,000 loan @ 12%:

- 24 months = ₹7,061 ✅ Comfortable

- 36 months = ₹4,981 ✅ More comfortable

- 48 months = ₹3,950 ✅ Very comfortable

Strategy 6: Prepay When Possible

Prepayment Benefits:

- Reduces outstanding principal

- Cuts future interest burden

- Closes loan faster

Smart Prepayment Strategy:

- Use annual bonuses for prepayment

- Prepay in first 2 years for maximum interest savings

- Check for prepayment penalties (typically 2-5%)

- Some lenders allow partial prepayment without charges

Prepayment Example:

- Loan: ₹1,00,000 @ 12% for 36 months

- EMI: ₹3,321

- After 12 months, prepay ₹20,000

- New EMI: ₹3,321 for remaining 24 months

- Interest Saved: ₹3,845

Strategy 7: Consider Balance Transfer

If you have an existing bike loan with high interest:

Balance Transfer Process:

- Find lender offering lower rate (1-2% less)

- Apply for balance transfer

- New lender pays off existing loan

- You continue with lower EMI

Example:

- Existing Loan: ₹80,000 @ 16% | EMI: ₹2,825 (36m)

- After Balance Transfer: ₹80,000 @ 13% | EMI: ₹2,695

- Monthly Saving: ₹130 | Annual Saving: ₹1,560

Bike Loan Eligibility Criteria: Who Can Use Bike EMI Calculator

Basic Eligibility Requirements for Two Wheeler Loans

Age Criteria

- Minimum Age: 18 years (some lenders require 21)

- Maximum Age: 60-65 years (at loan maturity)

- Co-applicant accepted if age exceeds limit

Income Requirements

Salaried Individuals:

- Minimum Monthly Income: ₹10,000 – ₹15,000

- Job Stability: 1 year in current job (some require 6 months)

- Total Work Experience: 2+ years

Self-Employed Individuals:

- Minimum Annual Income: ₹2-3 lakh

- Business Vintage: 2-3 years minimum

- ITR for last 2-3 years

- Bank statements showing regular income

Credit Score Requirements

| Score Range | Eligibility Status |

|---|---|

| 750+ | Excellent – Instant approval likely |

| 700-749 | Good – Standard approval |

| 650-699 | Fair – May require co-applicant |

| Below 650 | Poor – Likely rejection or very high rates |

Documentation Required

Identity Proof:

- Aadhaar Card

- PAN Card

- Voter ID / Passport / Driving License

Address Proof:

- Aadhaar Card

- Utility Bills (electricity, water)

- Rental Agreement

- Bank Statement

Income Proof:

For Salaried:

- Last 3 months’ salary slips

- Last 6 months’ bank statements

- Form 16 / IT Returns

- Employment certificate

For Self-Employed:

- Last 2-3 years’ IT Returns

- Business registration documents

- GST registration

- Last 6 months’ bank statements

- Balance sheet and P&L statement

Additional Documents:

- Passport-size photographs (2-3)

- Bike quotation/invoice

- Existing loan statements (if any)

Other Eligibility Factors

Employment Type: ✅ Salaried employees (easier approval) ✅ Self-employed professionals ✅ Business owners with ITR ❌ Unemployed individuals (rejected)

Residential Status: ✅ Indian residents ✅ NRIs (select lenders with special schemes)

Existing Loans:

- Total EMI obligations should not exceed 50-60% of income

- No current loan defaults

Bike EMI Calculator vs Manual Calculation: Why Use Online Two Wheeler EMI Calculator

Advantages of Bike EMI Calculator Over Manual Calculation

| Factor | Bike EMI Calculator | Manual Calculation |

|---|---|---|

| Time Taken | 5 seconds | 10-15 minutes |

| Accuracy | 100% accurate | Prone to errors |

| Ease of Use | Very simple | Complex formula |

| Multiple Scenarios | Instant comparisons | Tedious recalculation |

| Cost | Free | Free but time-consuming |

| Additional Info | Shows total interest, payment schedule | Only EMI amount |

| Accessibility | Anytime, anywhere (mobile/desktop) | Requires calculator, paper |

| Visual Representation | Graphs, charts available | Manual drawing needed |

When to Use Bike EMI Calculator

✅ Before visiting dealership or bank ✅ When comparing loan offers from multiple lenders ✅ To determine affordable bike price range ✅ Planning monthly budget allocation ✅ Deciding optimal down payment amount ✅ Evaluating different tenure options ✅ Understanding total cost of borrowing ✅ During loan negotiation for leverage

Common Bike EMI Calculator Mistakes: Two Wheeler Loan Calculation Errors to Avoid

Top Mistakes When Using Bike EMI Calculator

Mistake 1: Using Ex-Showroom Price Instead of On-Road Price

Wrong Approach:

- Bike ex-showroom price: ₹1,00,000

- Calculate loan on ₹1,00,000

Correct Approach:

- Ex-showroom price: ₹1,00,000

- RTO registration: ₹8,000

- Insurance: ₹4,000

- Other charges: ₹3,000

- On-road price: ₹1,15,000

- Down payment (20%): ₹23,000

- Loan needed: ₹92,000

Impact: Underestimating loan by ₹12,000-₹15,000!

Mistake 2: Forgetting Processing Fees

Most calculators show pure EMI without processing fees.

Hidden Costs:

- Processing fee: 1-2% (₹1,000-₹2,000)

- Documentation charges: ₹500-₹1,000

- Stamp duty: ₹200-₹500

- Total: ₹1,700-₹3,500 extra upfront!

Mistake 3: Not Factoring in Annual Interest Rate vs. Monthly

Common Error: Entering 12% in calculator that expects monthly rate

Result: Grossly incorrect EMI calculation

Solution: Always check if calculator asks for:

- Annual interest rate (most common)

- Monthly interest rate (rare)

Mistake 4: Ignoring Prepayment Charges

Planning to close loan early? Check prepayment terms:

- Some lenders charge 2-5% penalty

- Others allow free prepayment after 12 months

- Factor this into total cost calculation

Mistake 5: Choosing Loan Based Only on Low EMI

Wrong Focus:

- ₹2,224 EMI looks attractive (60 months)

Reality Check:

- 24 months: EMI = ₹4,708 | Interest = ₹12,992

- 60 months: EMI = ₹2,224 | Interest = ₹33,440

- Extra Interest Paid: ₹20,448!

Right Approach: Balance EMI affordability with total interest cost

Mistake 6: Overlooking Credit Score Impact

Calculating with best-case interest rate without checking your credit score:

Reality:

- Calculator shows 11% rate

- Your credit score: 680

- Actual rate offered: 16%

- EMI difference: ₹300-₹500 more!

Mistake 7: Not Comparing Multiple Lenders

Using single lender’s calculator and assuming it’s the best deal.

Better Approach: Calculate on 3-4 platforms:

- HDFC Bank Calculator

- ICICI Bank Calculator

- Bajaj Finance Calculator

- Third-party aggregators (BankBazaar, Policybazaar)

Mistake 8: Forgetting Insurance Bundling

Some lenders bundle insurance in loan amount, inflating EMI.

Check:

- Is insurance cost added to loan principal?

- Can you get separate insurance (often cheaper)?

- Is it comprehensive or third-party only?

Bike EMI Calculator FAQs: Two Wheeler Loan Calculator Common Questions

Q1: What is a bike EMI calculator?

A: A bike EMI calculator is a free online tool that instantly calculates your monthly installment (EMI) for a two-wheeler loan based on loan amount, interest rate, and tenure. It helps you plan finances before taking a bike loan.

Q2: How accurate is the bike EMI calculator?

A: Bike EMI calculators are 100% accurate as they use the standard EMI formula approved by financial institutions. However, the final EMI may vary slightly due to processing fees, insurance, or additional charges that aren’t included in basic calculators.

Q3: What is the formula used in bike EMI calculator?

A: The formula is: EMI = [P × R × (1+R)^N] / [(1+R)^N – 1] Where P = Principal loan amount, R = Monthly interest rate, N = Tenure in months.

Q4: Can I get a bike loan with a 600 credit score?

A: It’s difficult but not impossible. Most lenders prefer scores above 650. With a 600 score, you may face higher interest rates (18-22%), stricter eligibility criteria, or loan rejection. Consider improving your score before applying.

Q5: What is the minimum down payment for a bike loan?

A: Typically 10-30% of the bike’s on-road price. Some lenders offer zero down payment schemes for applicants with credit scores of 750+ and stable income of ₹15,000+/month.

Q6: Which is better: shorter tenure with high EMI or longer tenure with low EMI?

A: It depends on your financial situation:

- Choose shorter tenure (24-36 months) if you have stable income and want to save on interest

- Choose longer tenure (48-60 months) if you need lower monthly burden, but accept paying more total interest

Q7: Can I prepay my bike loan without penalty?

A: Most lenders allow prepayment after 6-12 months. Check your loan agreement for:

- Prepayment lock-in period

- Penalty charges (typically 2-5% of outstanding amount)

- Some lenders offer zero prepayment charges

Q8: What is the maximum loan amount for a bike?

A: Most lenders offer up to ₹25-30 lakh for superbikes. For regular commuter bikes, loans range from ₹30,000 to ₹3 lakh. The amount depends on your income, credit score, and bike model.

Q9: How long does bike loan approval take?

A:

- Online applications: 24-48 hours

- Bank branch applications: 3-7 days

- Instant approval schemes: Same day (for pre-approved customers with excellent credit)

Q10: Is bike loan interest tax deductible?

A: No, personal bike loans are not eligible for tax deductions. However, if you use the bike for business purposes and take a business loan, interest may be tax-deductible under business expenses (consult a CA).

Q11: What happens if I miss a bike EMI payment?

A:

- Late payment penalty: ₹500-₹1,000

- Negative impact on credit score (drops 50-100 points)

- Loan marked as NPA after 90 days of non-payment

- Lender may repossess the bike

- Future loan applications may be rejected

Q12: Can I transfer my bike loan to another bank?

A: Yes, through balance transfer. Benefits include:

- Lower interest rate (1-2% reduction possible)

- Reduced EMI or tenure

- Better loan terms

- Processing fee: 0.5-1% of outstanding amount

Q13: Do all bike EMI calculators give the same result?

A: Yes, if the inputs (principal, rate, tenure) are identical. All calculators use the same mathematical formula. However, some advanced calculators also show processing fees, insurance, and total cost breakdown.

Q14: Can I change my bike loan EMI after approval?

A: Not directly, but you can:

- Prepay partially to reduce tenure (EMI remains same)

- Prepay partially to reduce EMI (tenure remains same)

- Request tenure extension (if facing financial hardship)

- Balance transfer to different lender with different terms

Q15: Is it better to take bike loan from bank or dealer?

A:

| Factor | Bank Loan | Dealer Finance |

|---|---|---|

| Interest Rate | 11-16% (Lower) | 15-22% (Higher) |

| Approval Time | 3-7 days | Same day |

| Processing | More paperwork | Less paperwork |

| Flexibility | More options | Limited options |

| Negotiation | Difficult | Easier (bundled deals) |

Best Approach: Calculate EMI for both options and choose the one with lower total cost.

Best Bike EMI Calculators Online: Top Two Wheeler Loan Calculators in India 2025

Recommended Bike EMI Calculator Platforms

1. Bank Websites

HDFC Bank Bike EMI Calculator

- URL: hdfc.com/loans/two-wheeler-loan/emi-calculator

- Features: Simple interface, instant results, amortization schedule

- Best For: HDFC customers

ICICI Bank Two Wheeler Loan Calculator

- URL: icicibank.com/personal-banking/loans/two-wheeler-loan

- Features: Detailed breakdown, graph visualization

- Best For: Visual learners

SBI Bike Loan Calculator

- URL: onlinesbi.sbi/personal-banking/loans/two-wheeler-loan

- Features: Conservative estimates, government bank rates

- Best For: Risk-averse borrowers

2. NBFC Calculators

Bajaj Finance Bike EMI Calculator

- Instant approval calculator

- Shows eligibility while calculating

- Pre-approved offers displayed

Hero FinCorp Two Wheeler Calculator

- Brand-specific calculators

- Special schemes highlighted

- Quick approval process

3. Comparison Platforms

BankBazaar Bike Loan Calculator

- Compares multiple lenders simultaneously

- Shows best offers based on profile

- Credit score check integrated

Paisabazaar Two Wheeler EMI Tool

- Personalized recommendations

- Rate comparison across 15+ lenders

- Application tracking

PolicyBazaar Bike Finance Calculator

- Comprehensive comparison

- Insurance bundling options

- End-to-end loan assistance

4. Automotive Portals

BikeDekho EMI Calculator

- Bike-specific calculations

- On-road price integration

- Model-wise EMI comparison

BikeWale Loan Calculator

- Detailed bike specifications

- Dealer financing options

- City-wise calculations

Bike EMI Calculator Tips: Expert Advice for Two Wheeler Loan Planning

Pro Tips from Financial Experts

Tip 1: Use the 35% Income Rule

Your bike EMI should not exceed 35% of your net monthly income.

Example:

- Monthly Salary: ₹30,000

- Other EMIs: ₹5,000

- Available for Bike EMI: ₹(30,000 × 0.35) – ₹5,000 = ₹5,500 maximum

Tip 2: Calculate True Cost of Ownership

Don’t just focus on EMI. Calculate:

- EMI: ₹3,000

- Insurance: ₹5,000/year = ₹417/month

- Maintenance: ₹1,000/month

- Fuel: ₹2,000/month (60 km/day @ 50 kmpl)

- Total Monthly Cost: ₹6,417

Tip 3: Use Multiple Calculators for Cross-Verification

Calculate on 3 different platforms to ensure accuracy and compare offers.

Tip 4: Factor in Future Income Growth

If expecting salary hike or bonus:

- Opt for slightly higher EMI

- Plan for prepayment with bonus

- Shorter tenure to save interest

Tip 5: Time Your Purchase

Best Times to Buy:

- Festival season (Diwali, Dussehra): Discounts + lower interest rates

- Year-end clearance: Old stock discounts

- New model launch season: Previous model discounts

Interest Rate Benefit: Save 0.5-1% during promotional periods!

Tip 6: Negotiate Everything

Don’t just accept first offer:

- Interest rate (quote competitor’s rate)

- Processing fee (ask for waiver)

- Insurance bundling (get separate quote)

- Free accessories or extended warranty

Tip 7: Maintain Emergency Fund

Before taking bike loan:

- Save 6 months’ EMI as emergency fund

- Ensures payment even during job loss or emergency

- Protects credit score

Tip 8: Read Fine Print

Check loan agreement for:

- Prepayment clauses and penalties

- Interest calculation method (reducing balance)

- Hidden charges (documentation, legal fees)

- Conversion fees (fixed to floating rate or vice versa)

Bike EMI Calculator Conclusion: Make Smart Two Wheeler Loan Decisions

Final Thoughts on Using Bike EMI Calculator

A bike EMI calculator is not just a mathematical tool—it’s your financial planning partner that empowers you to make informed borrowing decisions. By understanding how EMI is calculated, what factors affect it, and how to use the calculator effectively, you can:

✅ Choose the Right Bike: Within your budget, not just based on desires ✅ Select Optimal Loan Terms: Balance between EMI affordability and total interest cost ✅ Compare Lenders Effectively: Find the best interest rates and terms ✅ Plan Your Finances: Ensure bike ownership doesn’t strain your monthly budget ✅ Save Money: Thousands in interest by making informed decisions

Key Takeaways for Bike EMI Calculator Users

- Always calculate before visiting dealer – Knowledge is negotiating power

- Don’t just chase low EMI – Consider total interest paid over tenure

- Make substantial down payment – Reduces loan burden significantly (20-30% ideal)

- Improve credit score first – Can save ₹5,000-₹10,000 in interest

- Compare at least 3-4 lenders – Interest rate difference of even 1% matters

- Read beyond EMI – Processing fees, prepayment charges, insurance bundling

- EMI should fit 35% income rule – Don’t overstretch your budget

- Consider prepayment strategy – Early prepayment saves maximum interest

Your Next Steps with Bike EMI Calculator

Step 1: Use multiple bike EMI calculators (bank websites, comparison platforms) Step 2: Determine your comfortable EMI based on income (35% rule) Step 3: Check your credit score (free on CIBIL, Experian, or through bank apps) Step 4: Compare loan offers from 3-4 lenders Step 5: Negotiate interest rate and terms using competitive quotes Step 6: Calculate total cost including processing fees and insurance Step 7: Choose the loan with lowest total cost, not just lowest EMI Step 8: Plan for prepayment with bonuses or increments to save interest

Ready to calculate your bike loan EMI? Use a reliable bike EMI calculator today and ride your dream bike with complete financial clarity!

Disclaimer: Interest rates, loan terms, and eligibility criteria mentioned are indicative and based on market trends as of November 2025. Actual rates may vary by lender, applicant profile, and bike model. Always verify current rates and terms directly with lenders before making loan decisions. This article is for informational purposes and does not constitute financial advice.

Keywords: bike emi calculator, two wheeler loan calculator, bike loan emi calculator, motorcycle loan emi calculator, bike finance calculator, two wheeler emi calculator India, bike loan calculator online, how to calculate bike emi, bike emi calculator with interest rate, best bike emi calculator 2025